Crypto Trading: Beyond the Hype—Why It’s a Real Game Changer for Financial Independence

Introduction: The Narrative Has Shifted

If you’ve been following cryptocurrency for the past few years, you’ve likely heard every criticism imaginable. Crypto is a bubble. It’s only for speculators. It’s too volatile. It won’t last.

But here’s what’s actually happening: while the headlines focus on price swings and scandals, something far more significant is developing beneath the surface. Cryptocurrency trading has evolved from a niche experiment into a legitimate financial tool that’s democratizing access to global markets in ways traditional finance never could.

The shift is real, and it’s not about getting rich quick. It’s about freedom. It’s about options. And for millions of people in communities where access to global financial markets is restricted, it’s literally life-changing.

Let me explain why crypto trading deserves your serious attention—not because of hype, but because of fundamentals.

Part 1: The Financial Exclusion Problem (And Why It Still Exists)

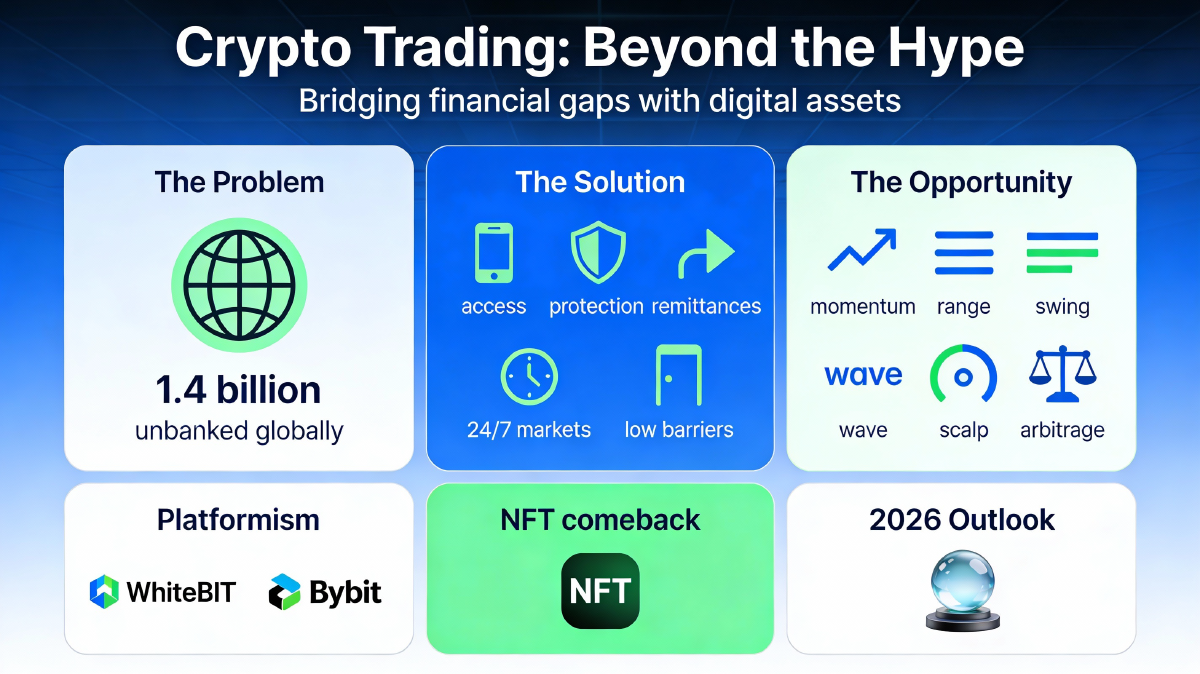

1.4 Billion People Are Locked Out

According to World Bank data, roughly 1.4 billion adults worldwide have no access to a bank account. These aren’t theoretical statistics—they’re real people living in real countries where traditional banking simply isn’t available, affordable, or trustworthy.

This isn’t just Africa or Southeast Asia (though those regions are disproportionately affected). Financial exclusion happens in wealthy countries too. In many nations, bank accounts require:

- Physical proof of residency (difficult if you move frequently)

- Government-issued ID (which many vulnerable populations lack)

- Minimum deposit requirements (€100+ that you don’t have)

- Monthly fees (eating into meager savings)

- Restrictive rules on who can access services

The result? Millions of hardworking people are forced to keep money under their mattresses, unable to save safely, unable to invest, unable to participate in the global economy.

Traditional Finance Isn’t Designed for Everyone

Here’s the uncomfortable truth: traditional banking infrastructure was built for people who already have money. It’s optimized for stability, for low-risk deposits, for the wealthy. It’s not designed for the unbanked, the underbanked, or people living in countries with unstable currencies.

If you’re a small business owner in an emerging market and you need to:

- Accept international payments (without a bank account)

- Send money to family abroad (without paying 7-10% wire fees)

- Store savings safely (without currency devaluation)

- Access credit (without extensive collateral)

…you’re out of luck with traditional finance.

Cryptocurrency changes this equation entirely.

Part 2: Why Crypto Trading Is Actually a Financial Liberation Tool

1. Access Without Permission

You don’t need permission to use crypto. You don’t need a bank account. You don’t need to prove your credit worthiness. You don’t need approval from a government official.

All you need is:

- A smartphone (which 5+ billion people own)

- Internet connection (increasingly available even in rural areas)

- A few dollars to start trading

That’s it. Within minutes, you can be trading on platforms like WhiteBIT (a European-friendly exchange offering 340+ cryptocurrencies) or Bybit (specialized in derivatives with up to 100x leverage). You have access to the same global financial tools that millionaires in New York use.

This isn’t theoretical. In countries where banks are corrupt, where the government freezes accounts, where currency collapse is a real threat—crypto is a genuine lifeline.

2. Protection Against Currency Collapse

Venezuela, Zimbabwe, Argentina, Turkey—in many countries, the national currency is being devalued in real-time. If you’re earning in that currency, your savings literally evaporate.

Crypto provides an escape valve. By holding stablecoins (crypto tokens pegged to the US dollar or Euro) or Bitcoin, people protect themselves against currency collapse. They’re not speculating—they’re protecting their life savings.

In 2026, we’re seeing institutional-grade stablecoins becoming mainstream payment instruments. For someone in an emerging market, this is revolutionary. Your savings don’t devalue overnight because a central bank made poor monetary policy decisions.

3. Remittances Without Gouging Fees

The global remittance market is massive: $700+ billion annually. But traditional wire transfers charge 7-10% in fees. A family sending $300 to a relative? They’re paying $30 in fees.

Crypto remittances? Typically €0.50-2.00, regardless of amount.

For a family in the Philippines sending money to relatives in the US, or a migrant worker in the Gulf sending savings home to Pakistan—crypto isn’t flashy or speculative. It’s purely practical. It means 5-10% more money actually reaches the family who needs it.

4. Access to Global Trading Markets

Here’s something most people don’t realize: crypto trading platforms allow you to participate in 24/7 global markets.

You can’t trade US stocks on a Tuesday night if you’re in Europe. The New York Stock Exchange closes at 4 PM Eastern time. You’re locked out.

But crypto markets never sleep. Bitcoin, Ethereum, altcoins—they trade 24 hours a day, 7 days a week, across all time zones.

For someone in a time zone where traditional markets are closed, crypto trading is genuinely the only option for active financial participation. You’re not waiting for “market open.” You’re trading in real-time, on your schedule.

Part 3: The Evolution of Active Trading Strategies in Crypto

What Active Trading Actually Means

Active trading doesn’t mean gambling. It means strategic decision-making to profit from price movements through disciplined analysis and risk management.

The crypto market has matured dramatically. In 2025, we’re not seeing the wild speculation of 2017. Instead, sophisticated traders are employing the same strategies that work in traditional markets—momentum trading, range trading, swing trading, scalping—adapted for cryptocurrency’s unique 24/7, high-volatility characteristics.

Key Active Crypto Trading Strategies

1. Momentum Trading

- Identify assets with strong price movements driven by news or volume

- Enter when momentum is confirmed

- Exit when momentum weakens

- Time horizon: Hours to days

- Best for: Volatile altcoins, Bitcoin during institutional adoption news

2. Range Trading

- Identify price support/resistance levels

- Buy near support, sell near resistance

- Repeat as price bounces within the range

- Works well in sideways markets (common in crypto)

- Requires: Volume confirmation and minimal breakouts

3. Swing Trading

- Medium-term strategy (days to weeks)

- Capture price swings in both directions

- Requires technical analysis skills (moving averages, RSI, MACD)

- Less time-intensive than day trading

- Risk: Overnight/weekend price gaps

4. Scalping

- Very short-term (minutes to seconds)

- Profits from small price movements

- Requires: Quick execution, tight bid-ask spreads, high trading volume

- Best on: Bitcoin, Ethereum (highest liquidity)

- Risk: High trading costs can eliminate profits if not careful

5. Arbitrage

- Buy on one platform at lower price

- Sell immediately on another at higher price

- Lower risk (less dependent on market direction)

- Requires: Fast execution, multiple platform accounts

- Challenge: Crypto market is increasingly efficient; opportunities are rare

The ActiveTrading.club Framework

Resources like activetrading.club represent the professionalization of active trading education. These platforms provide:

- Broker comparisons (assessing WhiteBIT vs Bybit vs others for your strategy)

- Strategy tutorials (momentum vs. swing vs. range trading)

- Risk management frameworks (position sizing, stop-losses, profit targets)

- Educational resources connecting theory with real execution

The key insight: active trading isn’t reckless. It’s systematic. It’s learnable.

Part 4: Understanding Your Platform Options (WhiteBIT vs. Bybit vs. Others)

WhiteBIT: The EU-Friendly Generalist Exchange

Best for: Beginners and intermediate traders, EUR support, altcoin diversity

Key Features:

- 340+ cryptocurrencies available

- Multiple trading modes: Basic (simplified), Spot, Margin (1:20 leverage)

- 10+ fiat currencies including EUR (excellent for German/European traders)

- Fixed 0.1% trading commission

- Investment options (staking, blockchain project investing)

- Mobile-friendly TradingView terminal

- €0.0005 BTC minimum deposit (extremely accessible)

Strengths:

- High liquidity and trading volumes

- Cold wallet security (98% of funds stored offline)

- WAF protection and US-based reserve funds

- Straightforward user experience for beginners

- EUR payouts (no currency conversion headaches)

Limitations:

- Limited educational content (you’ll need external resources like activetrading.club)

- Margin leverage capped at 1:20 (fine for most traders, limiting for derivatives specialists)

Ideal Use Case: You’re a European trader wanting access to diverse cryptocurrencies with fiat EUR support. You’re building long-term positions or practicing swing trading. You value simplicity over extreme leverage.

Bybit: The Derivatives Powerhouse

Best for: Advanced traders, derivatives/futures specialists, high-leverage strategies

Key Features:

- Specialized in derivatives (perpetual futures, quarterly futures, options)

- Up to 100x leverage available (extremely high risk/reward)

- Dual account system: spot trading + futures

- Zero-fee spot trading

- Zero deposit fees

- TradFi account (integrates MetaTrader 5 for stocks/forex CFDs)

- Bitcoin futures starting at just $1 (perfect for testing strategies)

- Cryptocurrency payouts (BTC, ETH, USDT)

Strengths:

- Deep order books and market depth

- Superior execution for active traders

- Mutual insurance against sharp market moves

- Flexible leverage settings (adjust risk per trade)

- ECN model (no markup, transparent pricing)

- Integration of crypto + traditional assets (stocks, forex)

Limitations:

- Crypto payouts only (you’ll need to convert to EUR)

- Steeper learning curve (designed for serious traders)

- Leverage can amplify losses quickly

- Limited basic education for beginners

Ideal Use Case: You’re a disciplined, technical trader. You want to trade derivatives (futures, options) with leverage. You’re comfortable with high volatility and strict risk management. You want 24/7 global market access without traditional market hour restrictions.

The Practical Comparison

| Feature | WhiteBIT | Bybit |

|---|---|---|

| Crypto variety | 340+ coins | Limited (100-200 major pairs) |

| EUR support | ✅ Yes | ❌ No (crypto only) |

| Spot trading | ✅ Yes (main focus) | ✅ Yes (secondary) |

| Derivatives | ✅ Limited (1:20 margin) | ✅ Extensive (1:100 leverage) |

| Beginner-friendly | ✅ Very | ⚠️ Moderate |

| Commission | 0.1% fixed | Variable (maker bonus available) |

| Best for | EUR traders, altcoins | Advanced traders, derivatives |

Part 5: What’s Happening with NFTs? (Spoiler: They’re Not Dead)

The 2025 Correction Was Necessary

Let’s be honest: 2021-2022 NFT craze was irrational. People paid thousands of euros for JPEGs. It was speculation at its purest.

But here’s what people miss: the crash was the healthy part. It cleared out the speculators and revealed what NFTs can actually do.

The NFT market experienced a 63% sales decline in 2025, dropping to $1.5 billion. By conventional thinking, NFTs are dead.

But examine what’s happening beneath the surface: The market is shifting from speculation to utility.

Utility NFTs Are the Future

Utility NFTs are tokens that provide actual function. Examples:

Gaming NFTs:

- In-game assets you actually own and can trade

- Digital twins connecting physical collectibles (like Pokémon cards) to digital ownership

- Earning mechanisms (play-to-earn integrating blockchain)

Access & Membership NFTs:

- FIFA World Cup 2026 tokens for exclusive access to games/events

- Loyalty programs where you hold NFTs for customer benefits

- VIP membership cards (digital but with real utility)

DeFi Integration:

- NFTs as collateral for loans (dynamic income streams)

- Passive yield generation for NFT holders

- Real-world asset (RWA) tokenization

The 2026+ Projection

By 2026, the global NFT market is projected to reach $45.44 billion, driven by:

- Enterprise adoption: Brands increasing NFT engagement by 25-40%

- AI/IoT convergence: Smart contracts automating real-world processes

- DeFi integration: NFTs generating actual income, not just sitting pretty

- Institutional investment: Traditional finance recognizing NFT utility

This isn’t hype revival. This is maturation. NFTs aren’t going away—they’re evolving into the financial infrastructure they were always meant to be.

Part 6: The Broader Crypto Ecosystem in 2026

Institutional Money Is Serious Now

The narrative has completely shifted from “Will Bitcoin survive?” to “How much will institutions allocate to crypto?”

Key developments in 2026:

- ETFs purchasing more than 100% of new Bitcoin and Ethereum supply (meaning institutions are accumulating faster than mining creates)

- CME futures showing record institutional participation

- Portfolio diversification (crypto now sits alongside gold, private credit in institutional allocations)

- Regulatory clarity attracting major financial institutions

This isn’t “crypto getting hyped again.” This is institutional capital allocation. It’s 50-year-old pension funds allocating to digital assets. That changes the game fundamentally.

Stablecoins: The Infrastructure Layer

Stablecoins (crypto tokens pegged to the US dollar or Euro) are becoming the “internet’s dollar” for global payments.

Why? Because they’re:

- Instant (settlement in minutes, not days)

- Cheap (€0.50 fees, not 7% wire fees)

- Borderless (work anywhere with internet)

- Programmable (can embed smart contracts for complex settlements)

For emerging market contexts, stablecoins are revolutionary. They allow people in countries with unstable currencies to hold value in stable assets without needing a traditional bank account.

Real-World Asset (RWA) Tokenization

By 2026, tokenized assets have crossed $36 billion: Treasury bonds, money market funds, private equity—all tokenized on blockchain.

The implication: Traditional finance and crypto finance are converging. You’ll be able to trade a tokenized US Treasury bond in the same platform where you trade Ethereum, settle instantly, and manage everything in one unified account.

Part 7: The Financial Freedom Argument

Active Trading as a Path to Independence (When Done Right)

Here’s what we need to be honest about: Most people shouldn’t day trade. Most day traders lose money. That’s documented fact.

But some people—disciplined, systematic, patient people—can use active crypto trading as a genuine income stream.

Why crypto specifically?

- 24/7 markets — You can trade on your schedule, not Wall Street’s

- Lower barriers — You can start with $50, not $25,000

- Volatility — Higher price swings mean more trading opportunities

- Global access — No geographic restrictions (crypto cares not about borders)

- Speed — Instant execution, no settlement delays

For someone in a country with high unemployment and limited income opportunities, learning disciplined crypto trading strategies could genuinely mean the difference between poverty and middle-class income.

This isn’t get-rich-quick fantasy. This is: “I learned swing trading, I practice risk management, I make €500/month additional income from trading.” That’s meaningful.

The Role of Communities (Like ActiveTrading.club)

Educational communities play a critical role here. They provide:

- Strategy frameworks (not “tips to get rich,” but actual trading methodologies)

- Risk management discipline (stop-losses, position sizing, portfolio allocation)

- Peer accountability (you’re less likely to make emotional decisions with community oversight)

- Collective intelligence (more eyes on opportunities reduce individual blind spots)

The quality of your trading education directly correlates with your trading success. Platforms dedicated to active trading methodology like activetrading.club are essential infrastructure for anyone serious about this path.

Part 8: Realistic Expectations and Risk Management

The Truth About Returns

Let me be direct: If someone promises you guaranteed returns from crypto trading, they’re lying.

Realistic expectations for active crypto traders:

- Day trading: 5-15% monthly returns (experienced traders with strict discipline)

- Swing trading: 10-30% monthly returns (less frequent trades, better odds)

- Scalping: 2-5% per trade (high frequency, low risk per trade)

- Bitcoin/Ethereum hodling: 20-100% annual (market dependent, low stress)

But here’s the catch: These are for disciplined traders who:

- Risk only 1-2% per trade (so losses don’t eliminate gains)

- Keep detailed records (so they learn from mistakes)

- Follow a documented strategy (not trading on emotion)

- Accept 30-40% drawdown periods (without panic selling)

Most people fail at one or more of these. That’s why most traders lose money.

The Volatility Is Real

Crypto can swing 10-20% in a day. That’s either exciting or terrifying, depending on your temperament.

If you’re trading Bitcoin and it drops 15% overnight, can you handle it calmly? Or will you panic-sell at the bottom? Your psychological resilience matters more than your technical analysis skills.

This is why paper trading (practice trading with fake money) is essential. This is why communities that reinforce discipline matter. This is why risk management frameworks (like those available at activetrading.club) are non-negotiable.

Conclusion: The Real Game Changer

Crypto trading’s “hype” status masks a deeper truth: it’s genuinely democratizing financial access in ways traditional finance can’t match.

For a trader in Berlin, it’s another options platform. For a freelancer in Lagos, it’s access to global markets without banking restrictions. For a family in Philippines, it’s remittances without exploitation. For a business owner in Argentina, it’s savings that won’t collapse with currency devaluation.

Yes, you can also use it to speculate. Yes, you can lose money. Yes, the volatility is real.

But underneath the volatility and hype is something genuinely important: a financial system that works for everyone, not just the wealthy in wealthy countries.

That’s not hype. That’s revolutionary.

If you’re serious about understanding crypto trading—not for hype, but for genuine financial skill-building—resources like activetrading.club and platforms like WhiteBIT and Bybit provide real infrastructure. Learn the strategies. Practice with discipline. Manage your risk obsessively.

Then you’re not just participating in a trend. You’re building a genuine financial capability that could change your life.

Your Next Steps

- Understand your baseline: Can you afford to lose €200? Start there.

- Learn one strategy deeply: Don’t chase 10 strategies. Master one (swing trading is great for beginners).

- Join a community: Places like activetrading.club aren’t hype engines—they’re discipline reinforcers.

- Choose a platform: WhiteBIT if you want EUR support and simplicity. Bybit if you’re serious about derivatives.

- Paper trade first: Practice with fake money until you’re profitable consistently.

- Then risk real capital: Only when you’ve proven you can win with fake money.

The game-changing part of crypto isn’t the technology. It’s the access. Now do something meaningful with it.

Disclaimer: This article is educational, not financial advice. Crypto trading involves substantial risk of loss. Only trade with capital you can afford to lose. Past performance doesn’t guarantee future results. Always conduct your own research.