10 Crypto Day Trading Strategies That Actually Work [Crypto-Edition]

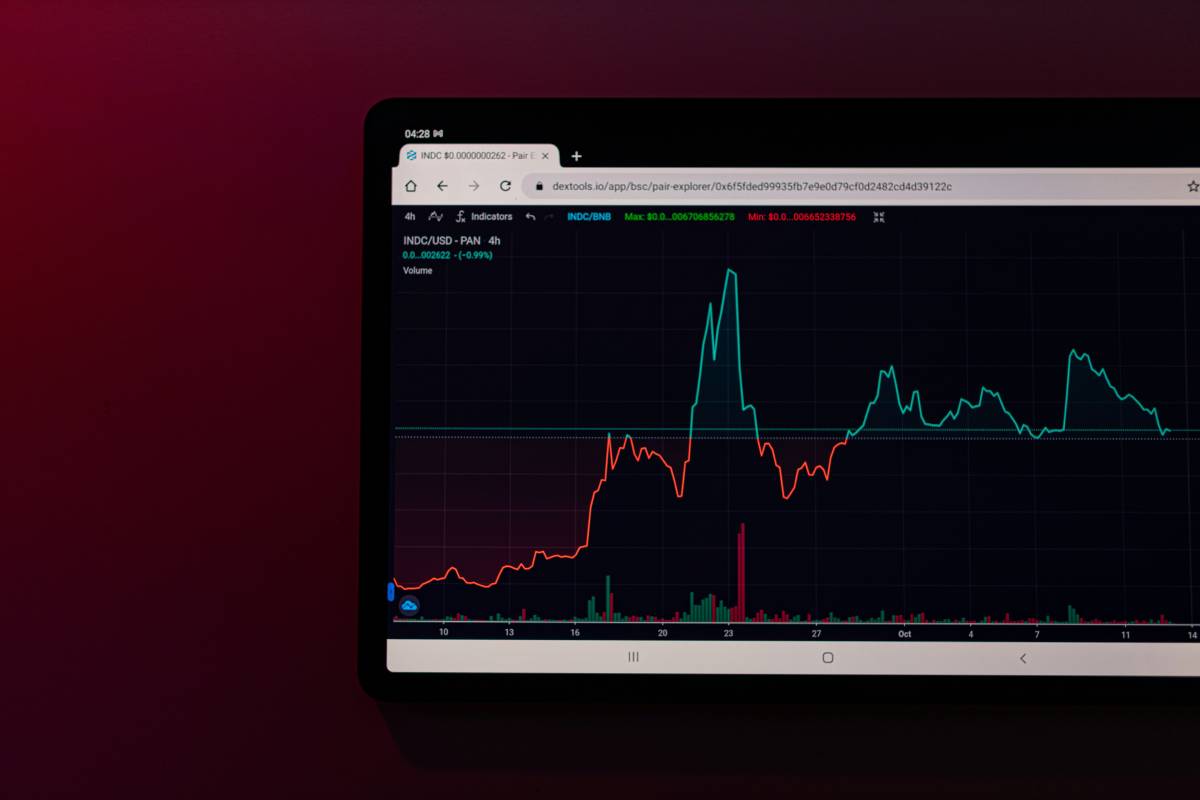

Introduction Cryptocurrency day trading requires proven strategies tailored to crypto’s unique characteristics: 24/7 markets, extreme volatility, and predictable momentum patterns. These ten strategies represent battle-tested approaches that professional crypto traders actually use to profit from intraday movements. Each strategy works in cryptocurrency specifically because crypto exhibits patterns that stocks don’t: extreme volatility creates larger intraday moves, market cycles repeat every 4 hours, and retail trading behavior creates predictable cascades. These aren’t theoretical strategies. Traders using these approaches generate consistent returns trading Bitcoin, Ethereum, and liquid altcoins. Master one before attempting another. Many of the most successful crypto day traders use just 1-2 strategies repeatedly rather than juggling all ten. The key: specific entry/exit rules that remove emotion. ...