Crypto Trading: Beyond the Hype—Why It's a Real Game Changer for Financial Independence

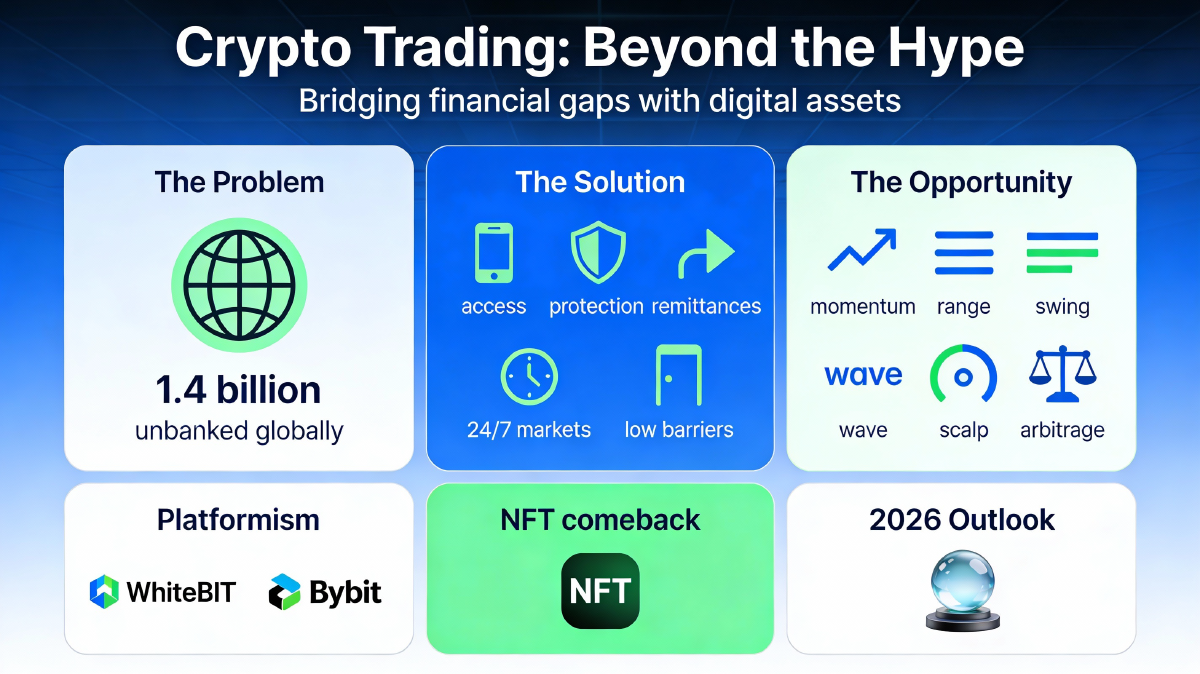

Crypto Trading: Beyond the Hype—Why It’s a Real Game Changer for Financial Independence Introduction: The Narrative Has Shifted If you’ve been following cryptocurrency for the past few years, you’ve likely heard every criticism imaginable. Crypto is a bubble. It’s only for speculators. It’s too volatile. It won’t last. But here’s what’s actually happening: while the headlines focus on price swings and scandals, something far more significant is developing beneath the surface. Cryptocurrency trading has evolved from a niche experiment into a legitimate financial tool that’s democratizing access to global markets in ways traditional finance never could. ...

Mastering the Crypto Basis Trade: How to Profit by Going Long DATs and Short Futures

Mastering the Crypto Basis Trade: How to Profit by Going Long DATs and Short Futures In the fast-paced world of cryptocurrency trading, many investors are constantly searching for strategies that offer consistent returns without exposing them to the wild swings of market direction. One such strategy—increasingly popular among both retail and institutional traders—is the crypto basis trade. At its core, this approach allows traders to profit from the structural differences between spot and futures markets, rather than betting on whether Bitcoin, Ethereum, or other digital assets will rise or fall. ...

Decoding Michael Saylor’s Bitcoin Strategy: A Practical Guide for Traders

Decoding Michael Saylor’s Bitcoin Strategy: A Practical Guide for Traders In the world of finance, few names have become as synonymous with Bitcoin as Michael Saylor. As the former CEO of MicroStrategy (now Strategy), Saylor has transformed a once-obscure business intelligence company into the world’s largest corporate holder of Bitcoin. His bold, controversial, and highly effective strategy has not only reshaped the company’s fortunes but has also influenced how institutional investors view digital assets. ...

How to Spot a Local Bottom in Bitcoin: A Practical Guide for Traders - Part 2

How to Spot a Local Bottom in Bitcoin: A Practical Guide for Traders – Part 2 Welcome back to the second and final installment of our series, How to Spot a Local Bottom in Bitcoin: A Practical Guide for Traders. In Part 1, we explored the foundational concepts of market structure, the psychology behind market bottoms, and the early warning signs that a local bottom may be forming. We discussed how fear, capitulation, and volume spikes can signal exhaustion in the selling pressure. ...

How to Spot a Local Bottom in Bitcoin: A Practical Guide for Traders - Part 1

How to Spot a Local Bottom in Bitcoin: A Practical Guide for Traders - Part 1 Understanding when Bitcoin has hit a local bottom—the point where its price stops falling and begins to rise again—is critical for traders aiming to capitalize on market reversals. This first part of our two-part series introduces the key concepts and practical tools to identify local bottoms in Bitcoin, laying the groundwork for mastering this vital trading skill. ...

Advanced Strategies and Real-World Applications

Advanced Strategies and Real-World Applications Mastering the Crypto Basis Trade: How to Profit by Going Long DATs and Short Futures – Part 3 of 3 Building on our previous posts—Part 1: Understanding the Crypto Basis Trade and Part 2: Executing the Basis Trade—this final installment dives into advanced techniques and practical applications that elevate the crypto basis trade from foundational knowledge to professional-grade implementation. You will learn how leverage, institutional approaches like ETFs and regulated futures markets, and nuanced exit strategies can optimize your profits while managing risks effectively. Real-world case studies and market insights will illustrate these concepts in action, empowering you to confidently apply these strategies across different market conditions. ...

Executing the Basis Trade: Step-by-Step Setup and Risk Management

Executing the Basis Trade: Step-by-Step Setup and Risk Management This post is the second in our series on mastering the crypto basis trade, designed to guide you through the practical execution and risk management of this market-neutral strategy using Delta Adjusted Tokens (DATs) and futures contracts. If you missed Part 1, Understanding the Crypto Basis Trade, I recommend reviewing it first to grasp foundational concepts like the basis, delta neutrality, and the rationale behind going long DATs and short futures. ...

Understanding the Crypto Basis Trade: Spot vs. Futures

Understanding the Crypto Basis Trade: Spot vs. Futures Part 1 of 3: Mastering the Crypto Basis Trade – How to Profit by Going Long DATs and Short Futures Welcome back to our series, “Mastering the Crypto Basis Trade: How to Profit by Going Long DATs and Short Futures.” In this first installment, we’ll lay the essential groundwork for understanding one of the most powerful market-neutral strategies in crypto: basis trading. ...

Applying Saylor’s Strategy: Practical Insights and Trading Implications for Bitcoin Investors

Applying Saylor’s Strategy: Practical Insights and Trading Implications for Bitcoin Investors In this final installment of our series, Decoding Michael Saylor’s Bitcoin Strategy: A Practical Guide for Traders, we translate Michael Saylor’s corporate Bitcoin acquisition blueprint into actionable insights tailored for individual Bitcoin traders and investors. Building on the foundational knowledge from previous posts—covering the feedback loops and financial mechanics behind Saylor’s approach—we now explore how volatility serves as vitality in Bitcoin markets, why a long-term holding mindset is critical, and how traders can interpret MicroStrategy’s buying patterns and stock performance to inform their own trading decisions. ...

The Feedback Loop and Financial Mechanics Behind Saylor’s Strategy

The Feedback Loop and Financial Mechanics Behind Saylor’s Strategy Welcome back to our series on decoding Michael Saylor’s Bitcoin strategy. In our previous post, we explored the foundational elements of how Strategy (formerly MicroStrategy) has positioned itself as one of the world’s largest corporate Bitcoin holders. Now we’re going to examine the more sophisticated mechanics that make this strategy self-reinforcing—the financial feedback loops that have allowed Saylor to accumulate massive quantities of Bitcoin while simultaneously growing shareholder value. ...